The Network Readiness Index (NRI) is a leading global indicator on the socio-economic impact of information and communication technologies (ICT) around the world. In its latest 2023 edition, the report maps the network-based readiness landscape of 134 economies based on their performances across four pillars: Technology, People, Governance, and Impact. Each of these pillars comprises three sub-pillars (see Figure 1) that have been populated by a total of 58 variables.

Figure 1: The NRI 2023 model

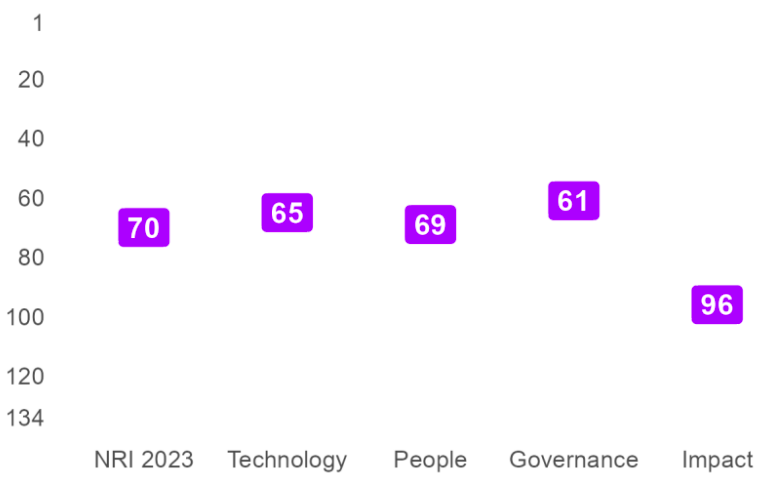

The top 10 performers in NRI 2023 underscore that advanced economies in Europe, the Americas, Asia, and the Pacific are leading the way in network readiness. The report benchmarks 31 African economies, with Kenya surpassing South Africa to claim the top position in Africa. Kenya’s main strength relates to the Governance pillar of the NRI (Figure 2).

Figure 2: Kenya’s global ranking, overall and by pillar

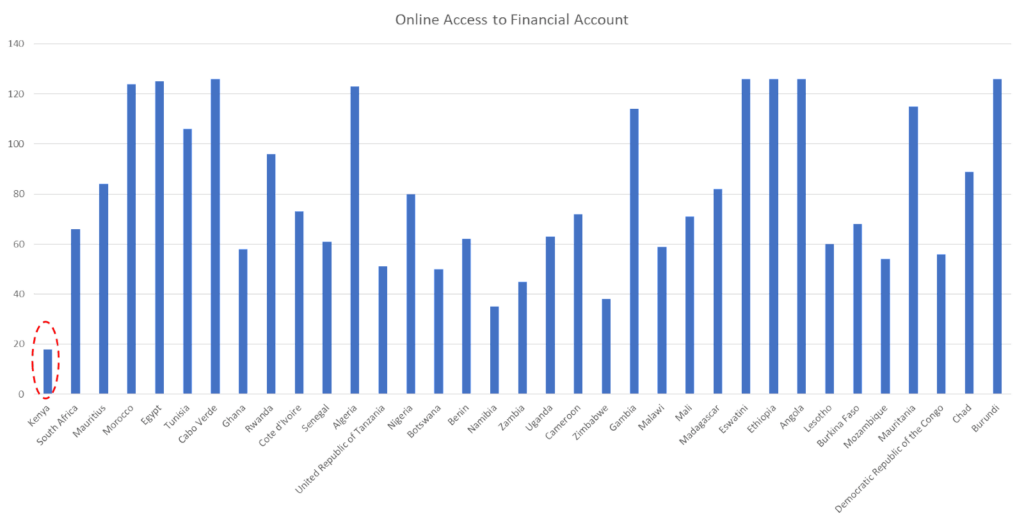

One key factor contributing to this performance is online access to financial accounts, where the country ranks 18th globally and 1st on the continent (Figure 3).

Figure 3: Online access to financial accounts NRI ranks across Africa

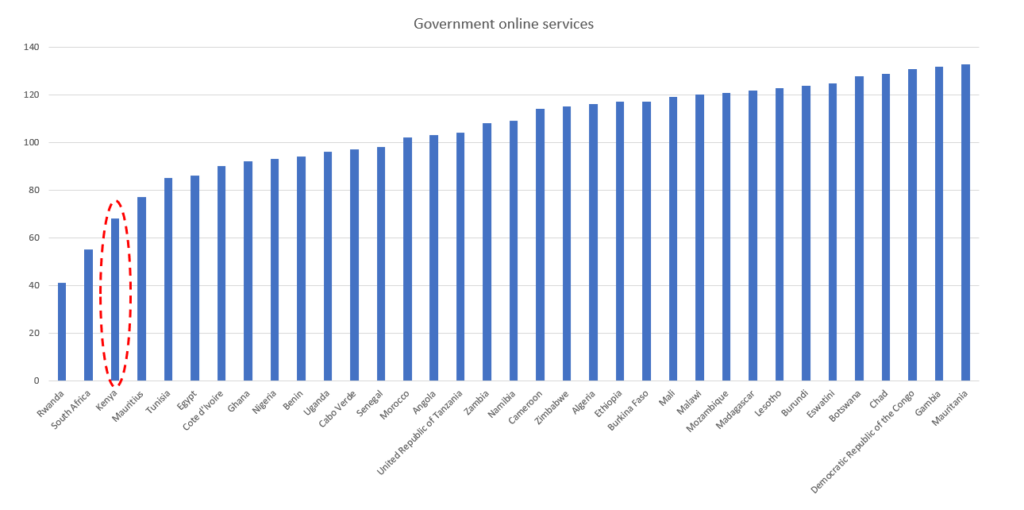

Since 2007, Kenya has emerged as a global leader in financial inclusion with the development of mobile money solution M-Pesa. The key innovation of M-Pesa was the transformation of cash into electronic money that could be accessed for financial transactions via a SIM card, which can also be integrated with an individual’s traditional savings bank account. M-Pesa’s singular success has since led to a series of endogenous innovations that have shaped Kenya’s digital ecosystem, especially with respect to e-governance and the complementary e-participation of its citizens, catapulting it ahead of other African countries, bar Rwanda and South Africa (Figures 4 and 5).

Figure 4: Government online services NRI ranks across Africa

Figure 5: E-participation NRI ranks across Africa

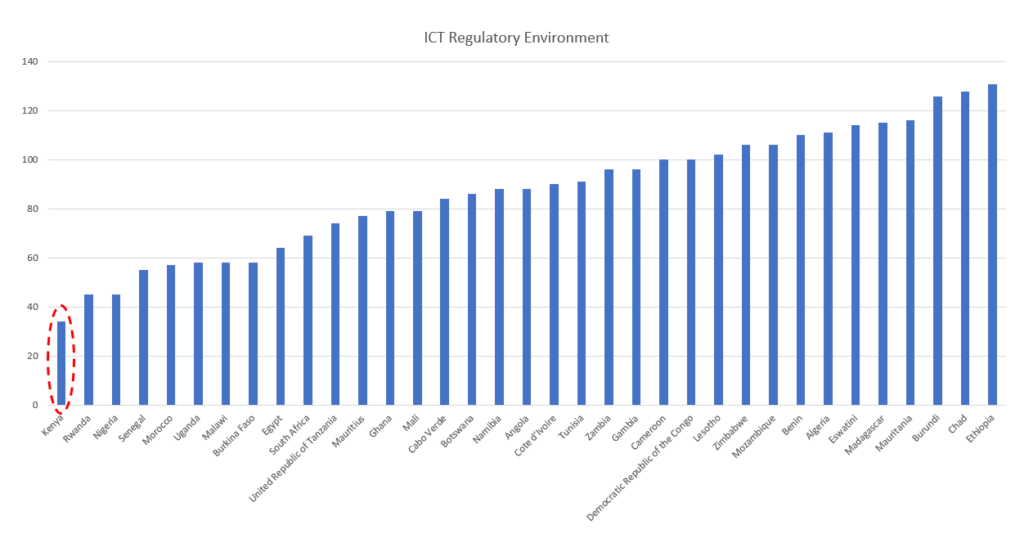

The above outcomes would not have been possible without progressive regulatory policies in its technology ecosystem – a pivotal element in driving the country’s success of globally renown digital innovation such as the M-Pesa – now the world’s most extensive mobile money system. In keeping with its historical stellar performance on this parameter, Kenya again takes the top spot in Africa for its ICT Regulatory Environment (Figure 6).

Figure 6: ICT Regulatory Environment NRI ranks across Africa

As a departure from the traditional mechanisms of economic planning, two key policy frameworks underpin Kenya’s ICT ecosystem – The Kenya National Digital Master Plan 2022-2032 and The Digital Economy Blueprint. Both policy documents depart from being just vision- and goals-driven, and incorporate an analysis of barriers and limitations for realizing their objectives in a globally competitive technology environment. Both policy documents are also well aligned to the broader National Development Plan (NDP) – Kenya’s Vision 2030, with implementation plans covering short-term and long-term activities for meeting the objectives of NDP. More specifically, the National Digital Master Plan has data protection and cyber security as critical pillars of ecosystem engagement, with clear governance structures and rules for effective cyber cooperation. With respect to global ICT regulatory benchmarking, Kenya is the only African country in the lead group of G5 regulators on the ITU Global ICT Regulatory Outlook, entering the global top 10 for the first time in 8th position. In particular, concerning the evolution of M-Pesa, the country’s regulatory innovation was evident as the Central Bank of Kenya (CBK) issued adaptive regulations that allowed M-Pesa to connect with individual savings accounts at commercial banks, even in the face of significant interest resistance from leading Kenyan banks.

Conclusion and the Way Forward

M-Pesa – as an endogenous innovation – has been pivotal to Kenya’s readiness to exploit the enormous opportunities offered by information and communications technology. In doing so, it has led to more inclusive digital development in the critical areas of regulatory innovation, e-governance, and e-participation of its citizens, crystallizing as a model for other developing countries, especially across Africa, in the evolution of a digital society. M-Pesa’s online access to financial accounts has also significantly enhanced the country’s financial inclusion position. However, realizing this critical endogenous innovation would not have been possible without some critical complementary network readiness parameters. Kenya continues to lead an exceptional performance in the African region with respect to International Internet Bandwidth on NRI 2023 (see Figure 7).

Figure 7: International Internet Bandwidth NRI ranks across Africa

As a best practice champion, the availability of affordable, accessible, resilient, and reliable infrastructure is the central pillar of the Kenya Digital Economy Blueprint. Within this focus, Kenya has made great strides in broadband coverage (both fixed and mobile) and, more importantly, has invested over 200 million USD in a National Optic Fiber Backbone Infrastructure (NOFBI) that spans over 9,000 Km and touches all the 47 counties that make up the country terrestrially. This provision maximizes the broadband capacity of the country’s various subsea optical fiber infrastructure, including the East African Marine System (TEAMS), SEACOM, East African Submarine Cable System (EASsy), Djibouti Africa Regional Express 1 (DARE 1), Pakistan and East Africa Connecting Europe (PEACE) cable, and Lower Indian Ocean Network II (LION II).

More so, the Kenyan digital ecosystem thrives on a functioning Universal Service Fund (USF) investment pool from the private sector that has catalyzed broadband growth in the country. Other complementary critical broadband infrastructures include two national exchange points (KIXPs) operated by the Technology Service Providers Of Kenya (TESPOK) for carrying international, regional, and local traffic, where different broadband connectivity operators exchange data traffic. Kenya has also established regional points-of-presence (PoPs) infrastructure linking the country to the national fiber-optic networks of Tanzania and Southern Sudan.Consequently, while M-Pesa has emerged as Africa’s leading online money service with more than 50 million customers and over 600,000 active agents operating across eight countries since its launch in 2007, the service must now begin to ramp up efforts in extending this endogenous innovation to the global market, especially to other emerging markets and lower-income countries beyond Africa where around 1.7 billion people still do not have access to traditional bank accounts.

Some critical target niche areas for the service include disrupting the cash-on-delivery challenge for e-commerce, especially within these emerging markets. This market mechanism can be scaled globally by leveraging its significant first-mover advantages in realizing more strategic partnerships with global payment processing companies, such as its long-standing relationship with global service provider -PayPal. Another key frontier area for M-Pesa’s evolution is the global cross-border remittance market, which has remained relatively underdeveloped even across Africa, especially from a financial infrastructure perspective where exclusivity agreements between banks and a few foreign money transfer agencies currently dominate, leading to the current situation where the cost of transactions across the continent is still one of the highest among developing regions.

To download a full analysis of Kenya’s performance in the Network Readiness Index 2023, visit https://networkreadinessindex.org/country/kenya/

Raymond Onuoha is a Technology Policy Fellow at the Lagos Business School (LBS) Nigeria, where his research focuses on the institutional and policy challenges in the evolution of the digital economy and technology innovation in developing countries, with a special focus on sub-Saharan Africa. In 2023 he was awarded an Africa Oxford Initiative Visiting Fellowship at the University of Oxford.